Unknown Facts About Pvm Accounting

Unknown Facts About Pvm Accounting

Blog Article

Pvm Accounting Things To Know Before You Get This

Table of ContentsFacts About Pvm Accounting UncoveredHow Pvm Accounting can Save You Time, Stress, and Money.Pvm Accounting - TruthsPvm Accounting Can Be Fun For EveryoneThe Only Guide for Pvm AccountingThe Pvm Accounting StatementsSome Ideas on Pvm Accounting You Should Know

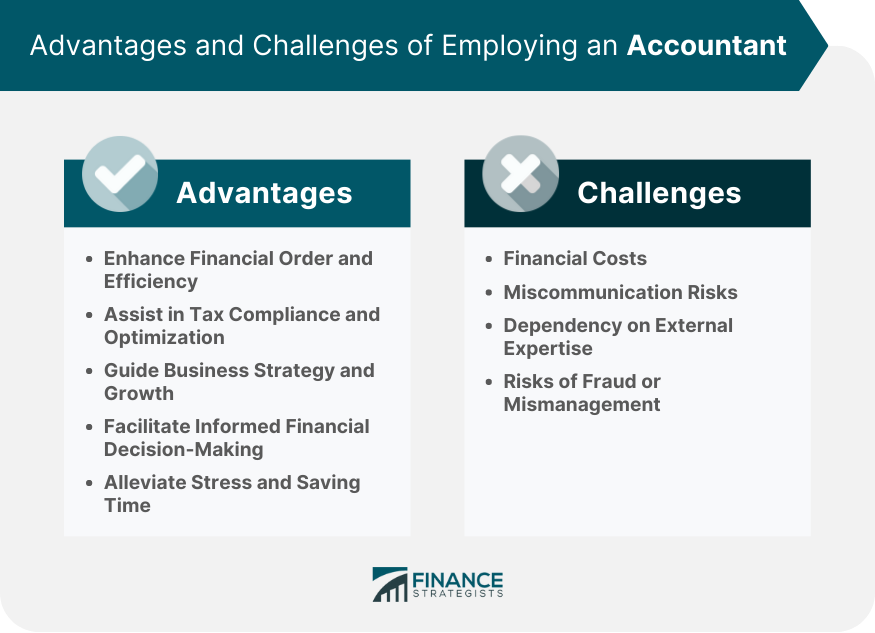

Is it time to employ an accountant? If you're an SMB, the appropriate accounting professional can be your buddy. At BILL, we've seen firsthand the transformative power that business owners and accountants can unlock together (financial reports). From simplifying your tax returns to examining finances for boosted productivity, an accountant can make a huge distinction for your service.

This is a possibility to obtain understanding right into exactly how expert monetary support can encourage your decision-making procedure and set your service on a trajectory of ongoing success. Relying on the size of your organization, you may not require to work with an accountantat the very least, not a full time one. Many local business enlist the services of an accounting professional only throughout tax time.

Are spread sheets taking over more and more of your time? Do you locate yourself annoyed tracking down receipts for costs rather of concentrating on job that's closer to your core goal?

Pvm Accounting Can Be Fun For Everyone

An accounting professional, such as a state-licensed accountant (CPA), has actually specialized expertise in economic administration and tax obligation compliance. They remain up to date with ever-changing guidelines and best practices, making certain that your organization stays in conformity with legal and regulative demands. Their understanding enables them to browse complicated economic issues and supply exact trustworthy recommendations customized to your specific business requirements.

Do you on a regular basis invest time on economic declaration preparation instead of working on organization monitoring? Funds can be time consuming, particularly for small business owners who are currently managing multiple duties.

About Pvm Accounting

Accounting professionals can take care of a variety of tasks, from accounting and monetary records to payroll handling, freeing up your schedule. When it comes to making monetary decisions, having an accountant's suggestions can be exceptionally important. They can provide economic analysis, situation modeling, and forecasting, permitting you to assess the potential influence of various alternatives before making a choice.

Some Of Pvm Accounting

For those that do not already have an accounting professional, it may be hard to know when to reach out to one. Every business is various, however if you are encountering difficulties in the following areas, currently may be the best time to bring an accountant on board: You don't have to compose an organization plan alone.

This will certainly aid you produce an educated monetary method, and offer you more self-confidence in your financial choices (Clean-up bookkeeping). Which legal structure will you pick for your company.?.!? Collaborating with an accountant guarantees that you'll make educated decisions about your firm's legal structureincluding comprehending your choices and the benefits and drawbacks of each

How Pvm Accounting can Save You Time, Stress, and Money.

Small company accounting can become challenging if you don't understand just how to manage it. Luckily, an accountant knows just how to track your finances in a variety of useful methods, including: Establishing up accounting systems and organizing monetary documents with help from audit software application. Aiding with cash money circulation management and providing insights into revenue and costs.

Assessing Get More Information expenses and recommending means to produce and adhere to budget plans. Giving evaluation and reporting for educated choice making. Maintaining you prepared for your income tax return all year long. Assisting you with the month-end close. Preserving a digital proof for meticulous document keeping. This is most likely the most usual factor that a little to midsize organization would employ an accounting professional.

The Of Pvm Accounting

By functioning with an accountant, businesses can strengthen their loan applications by supplying much more accurate financial information and making a much better instance for economic viability. Accounting professionals can likewise help with jobs such as preparing economic papers, assessing economic data to analyze credit reliability, and creating a comprehensive, well-structured lending proposition. When points transform in your business, you intend to make sure you have a solid manage on your finances.

The Ultimate Guide To Pvm Accounting

Accountants can aid you identify your business's value to aid you protect a reasonable offer. If you choose you're prepared for an accountant, there are a couple of simple actions you can take to make certain you discover the appropriate fit - http://www.askmap.net/location/6924027/united-states/pvm-accounting.

Report this page